|

$47 BILLION PINPRICK

POPS U.S. STOCK FUNDS

GuluFuture.com

2nd August 2002

PAGE

URL: http://www.gulufuture.com/future/fleefunds_z.htm

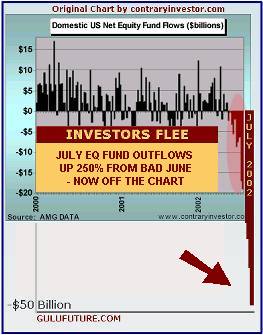

It's

all over, bar the shouting and the leaping from high window ledges. Investors

fled US equity mutual funds in July, according to Merill Lynch, with early

estimates forecasting a net outflow of $47bn from the funds - the LARGEST

EVER cash terms outflow in stock market history. It's

all over, bar the shouting and the leaping from high window ledges. Investors

fled US equity mutual funds in July, according to Merill Lynch, with early

estimates forecasting a net outflow of $47bn from the funds - the LARGEST

EVER cash terms outflow in stock market history.

However, from the paltry coverage in the rose-tinted media, this

calamitous sea change in small investor confidence never happened.

But there is now a despairing trend threatening the $4 trillion invested

in mutual equity funds. In June, there was a net outflow of nearly $18

billion, which was the third-largest on record.

"We could see sustained net outflows continue," David Bowers, chief investment

strategist at Merill Lynch told the Financial Times. Merrill had combined

data from ICI, TrimTabs and AMG Data Services to estimate the $47bn outflow

in July. On August 1, The Dow Jones Industrial Average slumped 2.6 percent

and the Nasdaq Composite dropped 3.6 percent.

If ever the dynamic towards war needed firming up, this provides the final

deadly impetus. The movement of the first sheep determines the direction

of the herd. If the investor stampede takes off, it will make 1929 look

like a small scale rehersal. Kick-starting the war machine is a long-planned

strategy by the US Administration to handle this well anticipated financial

crisis .

Wall St. crisis derails Japan

The

latest gloomy Wall Street developments have punctured Japanese hopes of

economic recovery. Non-government commentators have taken a very poor

view of Wall Street's impact on hopes of a Japanese recovery. The

latest gloomy Wall Street developments have punctured Japanese hopes of

economic recovery. Non-government commentators have taken a very poor

view of Wall Street's impact on hopes of a Japanese recovery.

In June, a report issued by the US Federal Reserve Board "Preventing Deflation:

Lessons from Japan's Experience in the 1990s," studied Japan's economic

bubble, aiming to prevent the bursting of the US stock bubble.

However, a researcher from a Japanese private sector think tank said:

"The report indicates that the US monetary authorities are very afraid

of the bubble bursting. They're worried that the United States will suffer

the same plight as Japan."

Economic Crisis Swells in South America

Back in the Americas, the crisis which began with Argentina's financial

meltdown six months ago, has now spread to neighboring Brazil, Uruguay

and Paraguay. It threatens to engulf other economies in the region as

well, including Bolivia and Venezuela, where deep recessions are now predicted.

In Brazil, Latin America's largest economy, government bonds have fallen

in recent weeks to half their face value, on fears of a government default.

In Uruguay, the government closed banks on Tuesday for the first time

in 20 years.

"We're becoming another Argentina," said Maurice Lopez, 45, a Montevideo

store clerk who waited today to withdraw cash from an ATM. "I can't believe

it has come to this."

Numerous nations in the region had begun to embrace U.S.-backed free market

reforms, including privatizations and lowered trade tariffs. Now, a backlash

has provoked rioting against sell-offs of state-run industries. Looters

raided supermarkets in Uruguay's capital Thursday, as unions protested

the banks closures.

The Gold Rush Takes Off

Meanwhile,

fifteen thousand gold and silver coins enthusiasts are expected to attend

the World's Fair of Money at the Marriot Marquis Hotel in Times Square,

New York. Yesterday, the attendance was so high that dealers were overwhelmed

by eager investors.

"I've sold more bullion in the last three months than in the first three

years of my store" said Ira Einhorn, owner of Coin Galleries of Oyster

Bay, a large Long Island's coin dealer. "It's like 1978 all over again."

That year marked the beginning of a bull market for coins, in which prices

on rare coins rose over 15 fold in two years. The same happened after

the stock market crash of 1987.

This

website, WWW.GULUFUTURE.COM, on 29th July, 2002

predicted that August 1st. would mark the

impact date of the financial system with an iceberg whose below-the-waterline

effects would dwarf the existing market falls and trigger a war. This

website, WWW.GULUFUTURE.COM, on 29th July, 2002

predicted that August 1st. would mark the

impact date of the financial system with an iceberg whose below-the-waterline

effects would dwarf the existing market falls and trigger a war.

|